Users of Indian overseas banks can use the bank’s mobile app to conduct many financial transactions to keep up with the digital trends.You can also see the transaction history via the app at any moment, manage multiple Indian overseas bank accounts, and receive the statements while doing other functions.

You can also use the BHIM Indian overseas bank UPI to make transactions at your convenience and at any time of the day.

For more information, you can continue to reason.

Table of Contents

What are the services offered by the Indian overseas bank?

Below are some of the services offered by the Indian overseas bank

- Deposit/loan view

- Check the status of the cheque

- Fund transfer from one bank account to another

- Payment by the credit card

- Stop a cheque

- Mini statements

- Indian overseas bank balance inquiry

- Top-up and bill payments

- Fund transfer to other bank accounts using the IMPS and NEFT facility.

What is the different type of Indian Overseas Mobile Banking apps?

| IOB Mobile Banking Apps | Primary features |

| IOB Mobile | Account Summary, Balance Check Fund transfer using NEFT, IMPS, RTGS |

| IOB mPassbook | Gives access to the customer’s passbook through the smartphone. Offline mode available |

| IOB Nanban | Non-financial transactions are available Check account balance, E-statement |

| BHIM IOB UPI | Transfer of funds 24/7 through QR code/ UPIReceive and send money using a virtual address |

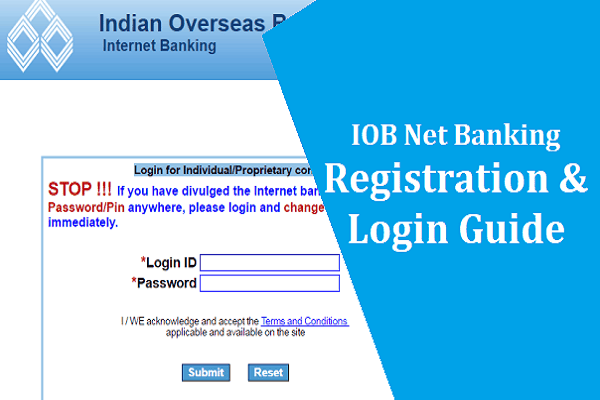

How can you register for Indian Overseas Bank Net Banking?

To register on net banking of Indian Overseas Bank, you need to follow the steps below.

- First, you need to visit the official website of the internet banking of Indian Overseas Bank.

- Now on the right-hand side of the website, you need to click on the online services.

- After that, you need to select retail banking under the register section.

- After that, you will be transported to the self-register page. After clicking on the ‘register online/self-user registration’ link, you need to read the terms and conditions and click on agree terms and conditions to proceed further.

- Now enter the required information and select the facility type, create login transaction IS and the password, and hit on submit button.

- Your user ID and login details will be displayed on the screen after successful submission. You need to keep it safe for future reference.

Register for Indian Overseas Banking via Phone Banking

First, you must provide the customer ID and the telephone Identification Number (TIN) if applicable. After that, you need to check the bank account information.

The customer care service representative will accept your internet banking request, and they will proceed further.

After that,the bank will send your net banking user ID and password to your mailing address.

Now you can activate your internet banking and start using net banking at any time with your ease.

How can you start using Indian Overseas Bank Banking App?

Signup for Indian Overseas Bank mobile banking is a very straightforward procedure. You can do so in three different ways.

Also read: CBI net banking Registration & Login Guide

Internet banking with Indian Overseas Bank

- First, go to the official website of Indian Overseas Bank and get the registration form. Fill out the form ultimately will all the required information.

- The mandatory information includes phone number, bank information, account number, address, name, and mobile number.

- Another option is to use the internet banking service. Here you need to login to the internet banking account, which is possible via the official Indian Overseas Bank website. After that, click on the edit profile option.

- Now select the ‘register mobile banking’ option

- After that, fill out the registration form, which should include the mobile number, email address, name, and account number. Then, select ‘yes’ for ‘mobile banking fund transfer facility’ and enter the ‘funds transfer PIN.’After filling in all the details, you must click the submit button.

- Now enter the OTP and hit on submit button again.

Visiting a bank branch

- First, go to the official website of Indian Overseas Bank, and you need to download the Indian Overseas Bank mobile banking registration form.

- Now you need to fill out the required fields.

- Now visit the Indian Overseas Bank branch which is near to your place.

- Now you must complete the registration form and follow the steps to enable Indian Overseas Bank mobile banking for the account.

Visit Indian Overseas Bank ATM

People having accounts in Indian Overseas Bank can sign up for the Indian Overseas Bank mobile banking at the ATM of Indian Overseas Bank. You need to follow the below steps for the same.

- Insert the debit card of Indian Overseas Bank into the ATM and enter your PIN.

- Now select the ‘other service’ option.

- Now you need to tap on the ‘mobile banking registration with debit card’ and complete the relevant details, and you are done.