Indian bank is a big nationalized bank. It comes under the ownership of the ministry of finance, and this ministry works under the government of India.

The Indian bank was started in 1907, and its headquarters is in Chennai, India.

There are more than 100 million customers connected with an Indian bank, and it also has 41,620 employees working in an Indian bank.

There are over 6004 branches and 5428 ATM machines and cash deposit machines installed all over India.

Indian bank is one of the country’s best-performing public sector banks.

The bank’s entire business is unbalanced with US$120 billion,i.e., 930,000 crore Rupees. You can continue reading the article for more information.

Table of Contents

Indian bank Net Banking

The bank’s information system and security procedures are certified with ISO27001:2013 standards.

It is one of the most popular certified banks in India. It also has branches in Colombo and Singapore, including a foreign currency banking unit at Colombo and Jaffna.

Indian bank also offers internet banking services, debit cards, credit cards, registration, and log-in to the portal.

Nowadays, internet banking is an essential aspect of every person’s life. With the help of internet banking, anyone can quickly transfer money from a bank to another bank account. For more details about Indian bank internet banking, please continue reading.

The bank has around 277 overseas correspondent banks. These banks are established in 75 countries.

The Indian government also started the bank in 1978. As per the declaration created by the ministry of finance, Allahabad bank is joining hands with the Indian bank, making it the seventh-largest bank in the country.

Every interested customer has to register for internet banking at an Indian bank. For this, you can use the official website of the Indian bank.

Indian bank internet banking summary

To have internet banking at an Indian bank, customers can provide their email id and mobile number at the nearest branch or branch where they have their savings or corporate account.

To complete the KYC, the customer must submit the supporting documents with identity proof.

You can also visit the official website of Indian banks to apply for internet banking.

Net baking offers the opportunity to transfer money online to any bank customer. To apply for the service, specific requirements must be fulfilled, and the primary one is registration.

After the registration, they can use the services anytime as per their need.

Because of COVID-19, internet banking has also played an excellent role in promoting digital India.

Indian bank internet banking registration procedure

You should follow the below steps to register yourself for Indian bank Internet banking

- First login to the official website of the Indian bank at indianbank.net.in

- After that, click on the login option for internet banking.

- Now enter the CIF number or account number and your registered mobile number.

- You must have received OTP on your mobile number; enter that in the critical area.

- Now you need to select one of the several services like transaction only, view only, and view + transaction both.

- After that, input a robust and secured login password with numerous combinations containing alphanumeric characters.

- To elevate the level of security, you can also set security questions to appear in front of you.

- Now you need to provide activation in the Indian bank internet banking services.

- You can also read the terms and conditions before selecting the continue button.

- Now you have to give your account number, ATM card details like expiry, card number, name, and PIN for confirmation and hit on submit button. It will be activated 24 hours after submission.

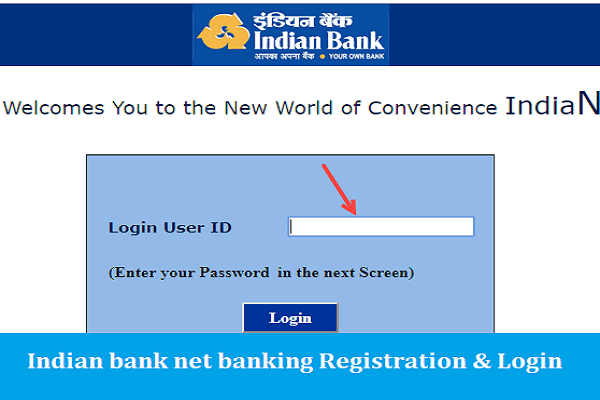

How to do Indian Bank Internet Banking login?

- First, you must visit the official website of Indian bank internet banking.

- After that, you need to select from individual or corporate.

- Input your Indian bank user ID and answer the expression.

- Hit continue

- Now enter your account password, click the login button, and verify your credentials.

- After that,you are on the home page of Indian bank internet banking.

Also read: BOI Internet Banking Login & Registration Process

How to add beneficiaries to the Indian Bank Netbanking?

You need to follow the below steps for adding a beneficiary.

- First, login to the Indian Bank net banking portal with the help of your user ID and password.

- Now you need to select the fund transfer option under the accounts tab.

- After that, click on add beneficiary.

- Now you have to select the ‘add payee’ from the same bank, or you can also add pay of any other bank as per your need.

- Now enter the account number, IFSC code, account name of the beneficiary, and other details asked on the portal and click on add.

- Now you need to enter the OTP received on your registered mobile number.

- Now your beneficiary is added, and you can transfer funds after some time.