As the name suggests, a crypto market maker buys and sells digital assets to facilitate trading. This activity is a vital part of the cryptocurrency ecosystem and ensures that there is always someone on the other side of a trade. Market makers are also essential in stabilizing both the crypto and traditional markets. However, becoming a market maker requires a ninja-level of skills and resources.

To be a crypto market maker, one must submit both buy and sell limit orders on various exchange platforms and Over-The-Counter (OTC) markets. Market makers then adjust their order books accordingly based on market conditions and their trading algorithms. The aim is to provide liquidity and reduce price volatility.

The most important thing to remember about being a crypto market maker is that it’s highly risky. Market making can be lucrative if you know how to properly manage your risk and take advantage of market opportunities. However, it’s easy to lose money if you don’t have a solid plan in place and aren’t careful with your money.

Also Read: How to Set Up a Huobi Trading Bot?

A key challenge for market makers is to find buyers for their inventory at the right time. If they sell their assets too early, they’ll miss out on a higher price. On the other hand, selling assets too late can result in lower prices and a loss of capital. This is known as the inventory risk, and it’s a risk that exists on all market types, including the cryptocurrency markets.

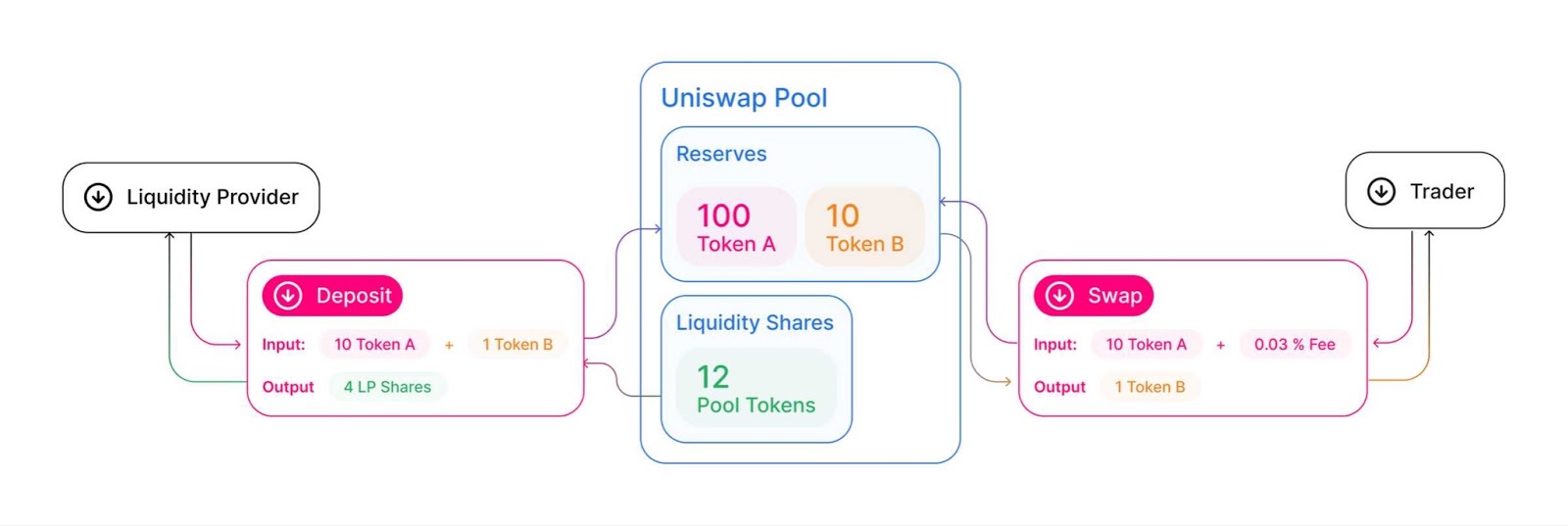

Another way that crypto market makers make money is by generating profits from the bid-ask spread. This is the difference between the highest offer and the lowest ask price for a digital asset. Essentially, the more illiquid a market is, the greater the bid-ask spread will be. Market makers can generate a profit by filling orders and reducing the bid-ask spread, which makes them a vital component of any cryptocurrency marketplace.

The best crypto market maker offer a variety of services to their clients, including aggregating the available liquidity from their own order books and those of other market makers. In addition to this, they also offer customized solutions and risk management strategies for their clients. Gotbit, for instance, offers market-leading liquidity across both DEX and CEX markets, and its platform is backed by robust algorithms. Moreover, it uses a global macro approach and theoretical research to equip global financial markets.